Capital Gains Tax- Calculation and inclusion rates

0

A capital gain or loss is calculated separately in respect of each asset disposed. Once determined, gains or losses are combined for that year of assessment and if it is:

- an assessed capital loss, it is carried forward to the following year, or

- a net capital gain, it is multiplied by the inclusion rate and included in taxable income

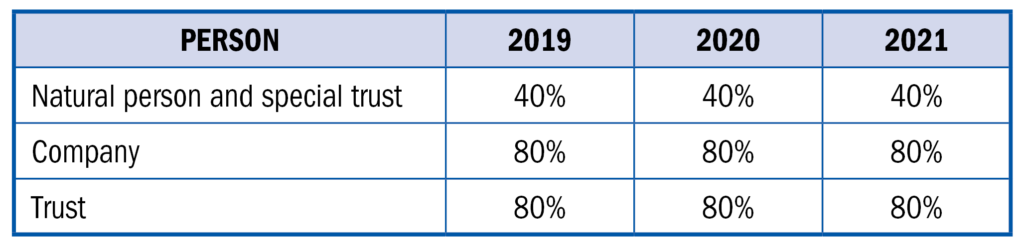

The inclusion rates are as follows: